(A Square in Front of Tokyo Station)

(A Square in Front of Tokyo Station)What Happened in 1995 and 2005 (While Overwhelming Economics)

"Ce qui s'est passé en 1995 et 2005"

The article in question written by Mr. Alan Greenspan is found in the following Web page:

http://opinionjournal.com/editorial/feature.html?id=110010981

SECTION 1: The Galvanized Year 1995

First of all, Mr. Alan Greenspan should take a look at the following two charts:

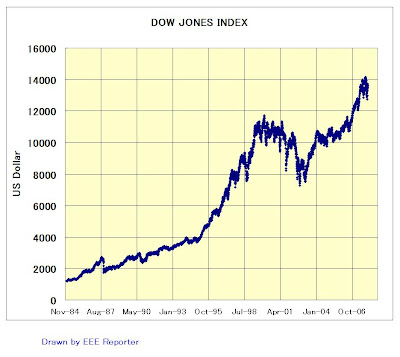

Fig. 1: DOW JONES INDEX TREND SINCE 1984

Fig. 1: DOW JONES INDEX TREND SINCE 1984 Fig. 2: THE NUMBER OF PCs IN USE IN THE U.S.

Fig. 2: THE NUMBER OF PCs IN USE IN THE U.S.(And, remember, Alan, that it does not include shipments of software which would more impressively explain what gave extravagant spurs to the NYSE index with a multiplier effect, though I don't know specifically what software programs you have used to analyze these trends.)

It is apparent that you have to focus on the change that happened in 1995.

It tells why productivity was so abruptly increased in 1995.

It tells why US economy was boosted so much in 1995.

And, everybody calls it the "IT Boom."

Indeed, it is because American consumers and businesses suddenly started to leverage the power of Windows 95 (Microsoft), with an embedded function to connect to the Internet, and the Pentium Processor (Intel) both of which were put into market in 1995.

Truly, American consumers and businesses started to leverage in full scale the IT power in order to increase efficiency and expand their activities, personal and official, in 1995.

It also boosted venture minds, business minds, and exploration minds of American citizens, since they got new means and weapons so smart, interesting, and effective, which satisfied their pride as well as hidden needs.

Since 1995, a file means an electrically-formatted file in a personal computer, which is software, and no more paper sheets, which are hardware, in a cabinet.

But, the above two figures also mean something important that is within a specialty of Mr. Greenspan.

Based on an experience of the so-called Black Monday in the global stock market in 1987, the financial sector began to design and create more effective computer programs for dealing with money transactions by leveraging the power of Windows 95, the Pentium Processor, and the efficient new telecommunications technology.

Put short, the IT power started to fully penetrate into the stock market and people concerned in 1995 at an unprecedented speed and efficiency, so that the money game entered a new phase which is so virtual and remote from the real world which is not at such a speed and efficiency.

And most importantly all the American citizens and consumers were galvanized by the power of Windows 95, the Pentium Processor, and the new telecommunications technology in 1995.

All the data, figures, charts, and analysis Mr. Alan Greenspan saw in his office in the subsequent years are just simple and natural logical consequences of the diffusion of Windows 95, the Pentium Processor, and the new telecommunications technology.

SECTION 2: The Alarming Year 2005

Now, Mr. Alan Greenspan should take a look at the following two charts:

Fig. 3: HOMES NEWLY BUILT IN THE U.S.

Fig. 3: HOMES NEWLY BUILT IN THE U.S. Fig. 4: DOW JONES INDEX TREND SINCE 2004

Fig. 4: DOW JONES INDEX TREND SINCE 2004It is late 2005 that the number of homes newly built in the U.S. started to decline while the stock market got another spur.

It is late 2005 that people concerned in the market and industry began to realize that the value of any homes in the U.S. would soon or later start to decline.

It is late 2005 that people concerned in the market and industry began to realize that the credit based on value of any homes in the U.S. would soon or later start to decline.

It is late 2005 that people concerned in the market and industry began to realize that the credit control involving houses should be tightened.

But, the Dow Jones Index got another spur in late 2005.

It is as if interest for a real asset started to be decoupled from interest for a financial asset.

Indeed, the real world economy, namely housing, was here again linked to the quasi-virtual world economy, namely the money game, in a new manner.

Securitization of the housing loans or mortgages not only introduced risks related to the real-world business, namely housing, to the quasi-virtual-world economy, namely the money game, but also introduced risks in the quasi-virtual-world economy into the real-world business.

The detachment of interest for a real asset from interest for a financial asset seems to have worked to increase the dangerous potential.

For some time, the money market was allowed to function according to its own rule and mechanism or interest; but at last in 2007 the gap between two kinds of interest has begun to break basements of both the economic sectors, the housing market and the money market.

And, the U.S. Government and E.U. member governments input several hundred billion US dollars only into the money market so as to keep a level of value of the stock market but not to the housing market, since they are essentially different types of economy.

But, the issue is of course the dangerous interaction or linkage still remained of the two economic sectors: the housing market and the money market.

SECTION 3: Mr. Greenspan's Optimism

The following is his key description on the sub-prime loan issue:

"...That weakened global investment has been the major determinant in the decline of global real long-term interest rates is also the conclusion of a recent (March 2007) Bank of Canada study.

Equity premiums and real-estate capitalization rates were inevitably arbitraged lower by the fall in global long-term interest rates. Asset prices accordingly moved dramatically higher..."

As money could not buy more money directly in the money market, people began to buy houses to sell them and get more money in the housing market.

"...The current credit crisis will come to an end when the overhang of inventories of newly built homes is largely liquidated, and home price deflation comes to an end... Very large losses will, no doubt, be taken as a consequence of the crisis. But after a period of protracted adjustment, the U.S. economy, and the world economy more generally, will be able to get back to business. "

This is an old well-known pattern of a bubble economy, so that it would follow suit of the past cases. It is not the end of the world. Rich men should not worry about it, according to Mr. Greenspan.

SECTION 4: Economists in Real World and Virtual World

There are millions of Americans working hard with sound minds and proper influential power.

I call them economists in real world, since they act while thinking about various things related to economy.

The total amount of their intelligence of, and speculation and decision by, those Americans working hard in the real world surpasses the level of intelligence of, and speculation and decision by, any economist in his/her office in an institute or an agency.

As millions of Americans working hard in the real world began to use Windows 95 and the Pentium Processor as well as the Internet with such venture minds in such innovative ways so enthusiastically, they could open a new era in economy, good or bad.

They should be called "Economists in the Real World."

Mr. Greenspan and other "Economists in the Virtual World" should remember that no professional economists declared their idea in the following manner before 1995:

"Makers should create Windows 95 and the Pentium Processor as well as the new telecommunications technology to use the Internet, so that tens of millions of citizens and consumers could routinely use them at low costs so as to increase productivity and boost the economy, so that the financial sector can leverage them in the money market."

Indeed, the Industrial Revolution was the first; economists, including Marx and Keynes, were the second.

Truly, technology evolution and people's venture are still the first; economists are yet the second.

(However, Mr. Greenspan studied history well and focused on Japan, fairly or sarcastically, in whatever context:

"There was clearly little the world's central banks could do to temper this most recent surge in human euphoria, in some ways reminiscent of the Dutch Tulip craze of the 17th century and South Sea Bubble of the 18th century."

"The depth of these markets became readily apparent in March 2004, when Japanese monetary authorities abruptly ceased intervention in support of the U.S. dollar after accumulating more than $150 billion of foreign exchange in the preceding three months. Beyond a few days of gyrations following the halt in purchases, nothing of lasting significance appears to have happened. Even the then seemingly massive Japanese purchases of foreign exchange barely budged the prices of the vast global pool of tradable securities.")

* * *

Once I wondered, seeing a picture of a big castle in Europe, what value it had if it had not been fully equipped with home electric appliances Japanese people were routinely enjoying in their homes, though their homes were usually very small and looked fragile.

Now, if you live in a big house in the U.S., I wonder what value it has if it is not fully based on love to God and neighbors.

Build a house not based on value estimated by somebody in an office with full of gangsters but based on a mission given by the God.

(In the global warming, everybody talks about only CO2.

But, CO2 is a result of fossil-fueled electricity generation or the driving of cars using fossil-fuel.

Why don't they talk directly about the sin of material life relying on the electricity generation and the use of cars instead of aiming at securitization of CO2?

You should also keep in mind the true and holy agenda being covered by unanimous blaming of CO2, even if you are expected to use the term CO2 so many times in a ceremony or any publicity.

Yet, you can live on the global warming issue, if you like, as your holy mission...)

"A SERVANT'S DUTY"

(Die Pflicht eines Dieners)